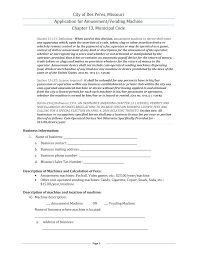

Vending Machine And Device Permit

Vending Machine And Device Permit

The requirements for obtaining a Vending Machine and Device Permit vary from state to state, and even city to city. Getting this type of license is vital to the success of your vending business. Whether you operate your business from home or in an office, a Vending Machine and Device Permit is required by law.

Regulations

Vending machines are an excellent way to sell snacks and beverages. They are often located in apartment complexes, laundry rooms, parks, playgrounds and party areas where people come and go 24 hours a day. To operate a vending machine, a person must first obtain a license from the Department. This license is required to be conspicuously affixed to each machine. In addition to this, the machine must have a sign that is visible to consumers, showing its permit number, business name and a unique identifier assigned to it by the permit holder. The sign must be of an approved size and style.

Fees

In addition to the Vending Machine and Device Permit, you will also need a Business License and Resale Permit. You will also need to register your fictitious business name within 30 days of opening the vending business. Sales of taxable items sold in vending machines, including but not limited to food and drinks, are subject to city sales tax. However, “honor box” sales are not included in this calculation of tax. To help reduce location fees, some vending machine businesses seek charity sponsorship. In this arrangement, the vending business owner donates space to a charity organization in return for a sticker that indicates that a portion of the machine’s income is donated to the organization. This arrangement can greatly reduce the cost of a vending machine location. For the charity organization, it is a great way to raise money for their cause.

Taxes

Taxes are based on the price you sell your goods for to the vending machine operator. For example, if you sell a drink for 11C/ or less, tax is not due. For items sold for 12C/ or more, the tax is measured by 117% of your cost of those items. The tax rate applies to all taxable items you sell through a vending machine, even those that are not taxable as food or nonreturnable containers. It is important to keep in mind that if your business has multiple vending machines or locations, you can compute your taxable sales by identifying the net invoice price of each item you sell through each machine!